Debt management and debt collections are a constant challenge for companies offering credit or products and services with scheduled payments, which have a high risk of generating delinquencies. For example, in 2023, the default rate on business loans increased by 23%, while defaults on services between companies rose by 4%. Internal data and research from inConcert indicate that after 90 days, the likelihood of collecting a debt drops by up to 85%.

In this context, GenAI technology emerges as a powerful and effective solution for boosting payment commitments and enhancing debt recovery efficiency. By automating calls and payment negotiations, companies can reduce costs, improve response times, and significantly increase recovery rates. Furthermore, AI’s capacity to manage multiple interactions simultaneously enables companies to scale their operations without the need to proportionally expand their team of human agents.

What is a Collections Voicebot?

A

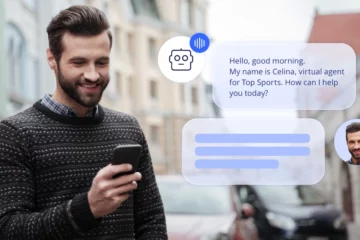

In the context of collections, a voicebot is specifically designed to manage and optimize the debt recovery process through voice conversations. It can both receive and initiate calls, and it verifies the debtor’s identity through security questions before providing any details. The voicebot can address frequently asked questions about the debt status, payment methods, and other relevant details, ensuring a seamless and efficient collection process.

How does a GenAI collections Voicebot work?

Collections are a race against time, and a well-structured omnichannel strategy is crucial for success in debt management. Integrating channels such as email, SMS, and calls with voicebots ensures that each debtor receives notifications through their preferred or most effective channel, increasing the likelihood of response and payment. In fact, 49% of users prefer voice channels for collections processes, underscoring the effectiveness of this approach.

Artificial Intelligence enhances these processes by offering personalized solutions tailored to the client’s needs. A collections voicebot utilizes historical CRM data and the client’s profile to provide responses and solutions aligned with their background, adjusting the tone and content of conversations based on the client’s situation. By interacting proactively and in real-time, the likelihood of recovering debts before they become uncollectible is significantly increased.

Let’s use a case of a mobile service provider as an example:

1. Initial Notification and Reminders:

- Automated emails: The process starts with an automatic email detailing the phone bill amount, due date, and available payment options.

- WhatsApp: If the email goes unopened, a follow-up WhatsApp reminder is sent after 3 days, requesting a payment commitment date.

2. Voicebot Interaction:

- Automated calls:If the customer does not respond to the email or WhatsApp message, automated calls are made by voicebots a few days later. These calls inform the customer of the overdue payment and offer an opportunity to discuss the outstanding balance.

- Negotiation and payment motivation:Voicebots use natural language processing to engage with the customer in real-time. One call focuses on negotiating new payment dates and encouraging immediate payment. The interaction is designed to be natural and conversational, simulating a genuine human exchange. Based on the insights gathered during these interactions, the AI can adjust payment proposals, offering plans that align with the customer’s financial situation and capacity to pay.

Discover Toyota Financial Services’ success story. View now

Discover Toyota Financial Services’ success story.

View now

Impact of Voicebots on Customer Experience

Can something as sensitive and potentially “uncomfortable” as debt collection actually enhance customer experience? Rather than demanding immediate payment, voicebots engage customers by asking questions and offering tailored solutions based on their financial situation and needs. Voicebots like inConcert’s, which features a diverse selection of 180 voices and languages, facilitate smoother and more human-like interactions with debtors.

By integrating automated and personalized messaging with self-service options, customers gain a sense of control and encounter fewer obstacles for payment. This approach not only enhances the customer experience but also leads to faster and more efficient debt resolution.

Additionally, these interactions help maintain a strong brand image and build stronger customer relationships, which are essential for long-term commercial success.

Whether your company offers financial services or other products, inConcert provides GenAI solutions, including voicebots, to meet your needs. Contact us to discover how these solutions can be applied to your business.

Webcast: Unlock your collections with our Voicebot GPT A View now

Webcast: Unlock your collections with our Voicebot GPT A

View now