Historically, companies in the insurance sector have faced a dilemma regarding customer experience, often swinging between extremes. On one hand, customers are highly satisfied, appreciating the peace of mind and financial and well-being that insurance coverage provides. In these instances, the relationship between the customer and the insurer is marked by trust, reliability, and satisfaction. Fast claims processing, clear communication, and personalized service contribute to this positive dynamic.

On the other hand, frustrations can easily arise when customers encounter obstacles in their interactions with insurance companies. Complex policy terms, disputes over claims, and unresponsive customer service can lead to confusion, distrust, and dissatisfaction. These negative experiences can make customers feel undervalued, prompting them to seek another insurer or voice their complaints through online reviews or to acquaintances.

This polarized nature highlights the importance of insurers prioritizing transparency, simplicity, and a customer-centric approach in their operations. AI is their best ally in achieving these goals.

IA para mejorar el servicio al cliente y reducir los tiempos de respuesta

Inadequate customer service, including long wait times, unresponsive representatives, or lack of personalization, can amplify frustration and dissatisfaction. Customers expect timely assistance and clear communication with their insurers. Failing to meet these expectations can lead to negative experiences, loss of customers, and financial losses for companies. For an insurer, acquiring new customers costs approximately 7 to 9 times more than retaining existing ones.

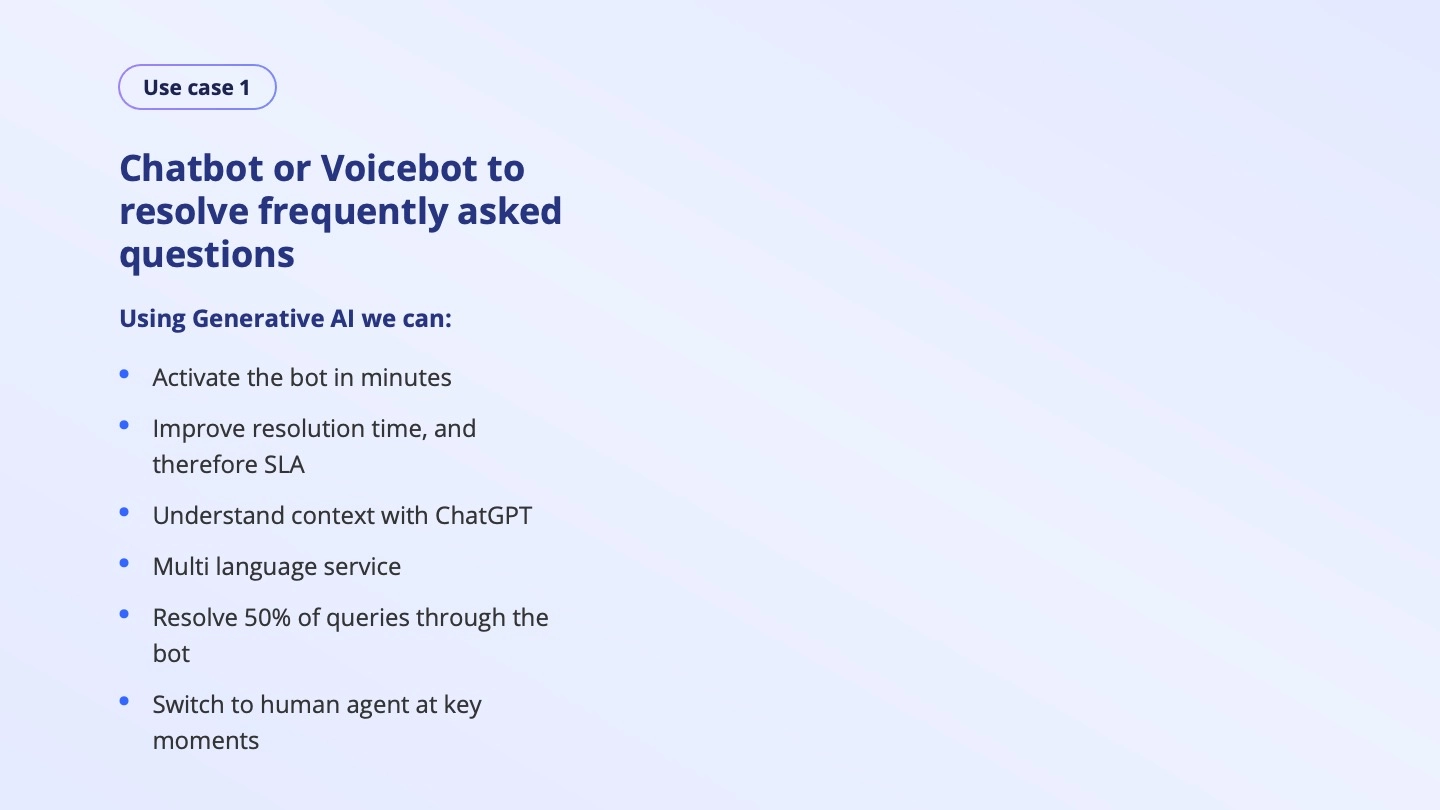

Thanks to the adoption of Generative AI, FAQ bots have become essential elements of customer service infrastructure, available 24/7 with no wait times. Their implementation significantly reduces the number of repetitive inquiries handled by human agents, which in turn shortens response times, provides more consistent answers, and enhances case resolution efficiency.

By integrating a customized knowledge base for the insurance industry, such as a glossary of terms, product catalog, and connecting it to the CRM, the bot can respond to a wide range of inquiries. These can include general questions like “What is a deductible?” to more specific and personalized queries such as “What do I need to start a claim for Sirius Trading Corp.’s medical insurance?”

Additionally, solutions like inConcert’s Knowledge Analytics are key for maintaining this knowledge base up-to-date while ensuring the bot’s training and upkeep through proactive auto-discovery of topics or potential future inquiries automatically.

Using Generative AI for effective and timely claim handling

Typically, filing an insurance claim is synonymous with a stressful and challenging time for the customer. Encountering obstacles such as denials, delays in resolutions, or insufficient explanations can cause tensions and erode trust in the insurer. Additionally, the process involves multiple steps and gathering a lot of information, which can be overwhelming in this context.

For these very reasons, it is crucial to manage customer claims as quickly, professionally, and efficiently as possible. Fortunately, AI has optimized these processes without sacrificing the human touch, transforming a complex procedure into a more user-friendly experience.

For example, technologies such as image and text recognition enable bots to collect the necessary documents to initiate a claim, extract the required information, and automatically fill out forms. They can also provide claim status updates at any time.

Additionally, compliance with regulations and guidelines is common in the sector. Using AI as a compliance tool can reduce manual processes, minimize human errors, and mitigate risks associated with fraud, forgery, erroneous resolutions, and more.

These are just a few examples of AI applications for insurers. However, the possibilities are much broader, including sales tasks, collections, support for human agents, obtaining feedback, and more.

In their pursuit of delivering consistent and positive experiences, insurers are turning to technologies like Artificial Intelligence to address pain points that often lead to customer frustration. By doing so, they can form stronger bonds with their clients and stand out in today’s fiercely competitive market.

The use of AI is no longer confined to the realm of science fiction; it has become a tangible reality embraced by our clients. If you’re interested in diving deeper into how this transformative technology can benefit insurers or other industries, inConcert stands ready to guide you through the implementation process.